A year of strong growth, margin expansion and cash generation. Delivering results and embedding sustainability.

Full-year highlights

- Reported revenue grew by 20.6% for the year, to $4,714m, and 17.8% for Q4. Constant currency underlying revenue grew 23.3% for the year and 19.1% in Q4.

- Constant currency underlying revenue growth was strong in all regions: Nigeria up 27.7%, East Africa up 22.7% and Francophone Africa up 17.2%; and across all key services, with revenue in Voice up 15.4%, Data up 34.6% and Mobile Money up 34.9%.

- Underlying EBITDA of $2,311m, grew by 29.0% in reported currency.

- Underlying EBITDA margin of 49.0%, increased by 294 basis points.

- Operating profit grew by 37.2% to $1,535m in reported currency.

- Profit after tax grew by 82.0% to $755m.

- Basic EPS of 16.8 cents, an increase of 86.5%. EPS before exceptional items of 16.0 cents (FY’21: 8.2 cents).

- Operating free cash flow of $1,655m, up 40.5%, with net cash generated from operating activities up 20.7% to $2,011m. Over the last twelve months the business has repaid nearly $1.4bn of debt at HoldCo as a result of strong cash upstreaming across its OpCos and proceeds from minority investments in mobile money and tower sales.

- Leverage ratio improved to 1.3x from 2.0x in the prior year, with $1bn of debt now held at HoldCo (FY’21: $2.4bn).

- Customer base of 128.4 million, up 8.7%, with increased penetration across mobile data (customer base up 15.2%) and mobile money services (customer base up 20.7%). NIN/SIM regulations in Nigeria impacted customer growth in H1, but then returned to strong growth, adding 4 million customers in Nigeria during H2'22.

- Board recommends a final dividend of 3 cents per share, making total FY’22 dividends 5 cents per share (FY’21: 4 cents).

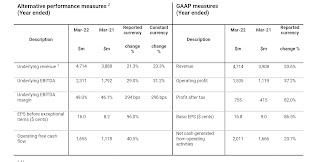

Alternative performance measures 2 | GAAP measures | |||||||

Description | Mar-22 | Mar-21 | Reported | Constant | Description | Mar-22 | Mar-21 | Reported |

$m | $m | change % | change % | $m | $m | change % | ||

Underlying revenue 1 | 4,714 | 3,888 | 21.3% | 23.3% | Revenue | 4,714 | 3,908 | 20.6% |

Underlying EBITDA | 2,311 | 1,792 | 29.0% | 31.2% | Operating profit | 1,535 | 1,119 | 37.2% |

Underlying EBITDA margin | 49.0% | 46.1% | 294 bps | 296 bps | Profit after tax | 755 | 415 | 82.0% |

EPS before exceptional items ($ cents) | 16.0 | 8.2 | 96.0% | Basic EPS ($ cents) | 16.8 | 9.0 | 86.5% | |

Operating free cash flow | 1,655 | 1,178 | 40.5% | Net cash generated from operating activities | 2,011 | 1,666 | 20.7% | |

(1) Underlying revenue excludes a one-time exceptional revenue of $20m relating to a settlement in Niger in the prior year.

(2) Alternative performance measures (APM) are described on page 51.

Segun Ogunsanya, chief executive officer, on the trading update:

“This is another strong set of results for Airtel Africa, demonstrating our solid execution as we continue to enrich the lives of a growing number of people through leveraging the sizeable opportunity to promote digital and financial inclusion across our markets.

We have delivered strong double-digit growth in revenues across all our regions and all our key services, with improving margins driven by strong cost control, and expanding cash generation which is enabling us to continue to invest in our network and services and expand our distribution, as well as strengthening our balance sheet and increasing our returns to shareholders. We are connecting more customers in new and existing coverage areas and driving usage levels and ARPUs to new highs.

We have successfully executed on a number of strategic initiatives in the year, with tower sales completed in four countries, $550m of minority investments secured for our mobile money business and a successful buyout of minorities in our Nigerian operation. Our receipt last month of a full PSB licence in Nigeria will help us to accelerate financial inclusion in the territory and drive our mobile money business even faster.

While the fundamentals of our six-pillar growth strategy remain unchanged, we are looking to accelerate our performance through a greater focus on digitalisation and we have underpinned our strategic pillars with our sustainability ambition.

I am particularly proud of the progress we have made in articulating our sustainability strategy this year as well as the partnership we announced with UNICEF to help drive and support educational programmes in our territories. I very much look forward to us publishing both our pathway to net zero and our first full sustainability report later in the year.

Turning to the outlook, long-term opportunities for us remain attractive. While mindful of currency devaluation and repatriation risks, we continue to work actively to mitigate all our material risks and to deliver value for all our stakeholders. There are increasing challenges from global inflationary pressures, but we continue to target revenue growth ahead of the market and moderate margin expansion.”

Airtel Africa plc (“Airtel Africa” or “Group”) annual financial information contained in this report is drawn from Airtel Africa plc’s audited annual consolidated financial statements for the years ended 31 March 2022 and 31 March 2021, prepared in accordance with the requirements of the Companies Act 2006 and International Financial Reporting Standards (IFRS) as issued by the International Accounting Standards Board (IASB) and approved for use in the United Kingdom (UK) by the UK Accounting Standards Endorsement Board (UKEB). Quarterly information is drawn from unaudited IAS 34 financials of respective periods. Comparative period figures have been regrouped/ reclassified to conform with current year grouping/ classification.

.jpeg)